A leading FMCG company wanted to understand consumer perceptions, usage contexts, and willingness to try/shift to a new product in multiple cities across India. They had a hypothesis regarding taste preferences, packaging appeal, and pricing sensitivity. However, they lacked nuanced qualitative understanding to guide launch decisions.

The key research objectives were:

- Validate the concept (appeal, clarity, differentiation)

- Uncover usage occasions, unmet needs, and barriers

- Estimate purchase intent and price thresholds

The Challenge

- The FMCG brand’s target segment included diverse consumers across geographies (metropolitan and smaller cities) who were less likely to respond to long, static surveys.

- The research needed both depth (qual insights) and breadth (quant coverage) to feed strategic decisions.

- Traditional in-depth qualitative interviews (in-person or remote) would be slow, expensive, and limited in scale.

- Open-ended survey responses often remain superficial unless probed intelligently (manual follow-ups are costly and time-consuming).

Our Solution: WhatsApp Bot + Maya AI for Smart Qual-Quant Integration

To overcome these constraints, we designed a hybrid research architecture combining the following:

1. Native WhatsApp-bot survey

- A conversational bot over WhatsApp delivered the quantitative survey. The survey was embedded with branching logic and visual aids (images, icons) to increase engagement.

- The bot flow included key closed-ended items on usage, preference, purchase intent and also triggered open-ended questions to solicit qualitative insight.

- Since the respondents are already accustomed to WhatsApp, the friction was low. This approach echoes our earlier success in reaching hard-to-reach segments via WhatsApp surveys.

2. Maya AI with Interactive AI probing

We overlaid Maya AI’s capabilities to elevate the richness of qualitative input and speed of insight extraction:

- Adaptive question probing: After a respondent’s open-ended answer, Maya AI (via the bot) dynamically issues follow-up prompts (“Can you tell me more about the experience?”, “What factors led you to say that?”, etc.). The AI used the OARS-style framework for conversational probing: Open-ended, Affirmation, Reflective listening, Summarization.

- Consistency & depth at scale: Each respondent receives probing that is consistent, empathetic, and tailored to overcome moderator fatigue or bias. Merren’s AI integration does not leave the job half-done.

- Real-time NLP & synthesis: As responses come in, the dashboard transcribes and analyzes responses, clustering themes, extracting sentiments, and surfacing highlight quotes- all while the survey is ongoing. This eliminates manual coding delays.

Implementation Approach

Phase | What We Did | Why / Benefit |

Design & pretest | Defined the survey structure: closed-ended core + branching open-ended probes. Set up rules for when Maya should trigger follow-ups. Piloted in two cities. | Ensured survey was error-free, questions easy to understand, probe logic worked. |

Campaign publishing | Rolled out across 5 cities over 5 days. Bot pushes the survey link via WhatsApp; reminders nudged completion. | Rapid deployment, high reach, low overhead. |

Live probing & monitoring | As respondents answered, the AI probed deeper immediately on open-ended inputs. Our team monitored live dashboards to spot emerging themes. | Real-time escalation and course correction. |

Analysis & synthesis | The dashboard surfaced transcripts, themes, sentiment scores and key quotes. Our analysts reviewed, refined, and structured the output. | Faster turnaround, qualitative insights ready within hours to days. |

Insights & recommendations | We overlaid the quant results (purchase intent, price sensitivity, segmentation) with qual findings (consumer narratives, emotional drivers, barriers). Delivered actionable guidance: positioning, messaging frames, packaging tweaks, pricing bands. | Integrated, grounded recommendations rather than “just data.” |

A Solution That Cut Through

Merren focused on WhatsApp surveys since the target respondents were already familiar with the interface.They used it daily to stay connected with family and friends.

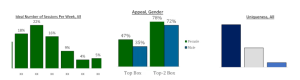

Merren crafted a customised WhatsApp survey that comprised:

- 20+ close-ended and open-ended questions around acceptability and likeability of the concept

- 8 short messages (that needed no response) to establish uniqueness, highlight the need, and emphasize purchase intention

- A 2-minute video that explained the concept clearly and answered anticipated questions

- A price sensitivity meter that helped the company arrive at optimum pricing

The survey immediately struck a chord with the target group. Its friendly, interactive design piqued interest and respected their life experiences, exactly what respondents wanted.

How Merren Published the Campaign

The survey was launched in:

- Two languages – Hindi and English

- Middle of the festive season- When engagement was traditionally tricky

- Five cities – Mumbai, Delhi, Lucknow, Surat, and Coimbatore

- Sample size – 400 respondents, completed in just 4 days

- Incomplete rate – less than 20%

Outcomes & Impact

- Higher completion & engagement: The conversational WhatsApp format, supported by AI-probing gave us genuine detailed responses and lower drop-off than typical static surveys.

- Depth within scale: Over 400+ respondents gave us genuine insights in 4 days despite the festival season.

- Faster insight cycles: What might have taken 2–3 weeks to code and analyze was compressed to just a few days.

- Better decision support: The client used the combined qual-quant outputs to refine the value proposition, choose pricing tiers, and tailor their launch messaging.

- Validated hypotheses + new discoveries: The study confirmed certain assumptions (e.g. preferred flavor variants) but also surfaced new usage occasions and latent pain points that the client had not considered.

Why Adding AI-Probing Integration Made the Difference

- From passive input to active conversation: Traditional surveys risk shallow or one-line answers; Maya turns them into dialogues that brings more meaningful responses.

- Consistent probing across respondents: Human moderators vary; Maya applies the same probing logic rigorously and impartially.

- Real-time insight extraction: By automating transcription, theme clustering, and sentiment extraction, Merren’a AI cuts out manual delays.

- Augmenting human analysts, not replacing them: Maya handles the repetitive, time-consuming parts so your team can focus on insight, strategy, and storytelling.

- Scalable depth: You can run this model across many segments or cities simultaneously without exploding cost or timelines.

Create Your Own AI Interviewer with Maya AI Today

In 2025 and beyond, speed is everything. Markets shift overnight, and teams can’t afford to rely only on surveys or gut feeling when making big bets. At the same time, traditional qual research hasn’t caught up – it’s slow, pricey, and often localized. We’ve seen amazing advances in AI (LLMs, NLP) and thought: why not use these to conduct qualitative research at scale?

Maya will help you overcome this barrier with empathy, intuitive probing and interactive experience. Maya is upgrading and improving with every iteration. If you want to be a part of the pilot, send us an email here.